Treasury

The Treasury department’s responsibilities include managing the liabilities side of Aker ASA’s balance sheet, particularly debt financing of Aker ASA and Holding companies, interest rate and currency hedging, and advising the operating companies on financing and capital structure. The unit also manages interest and currency risks that arise in our daily business activities.

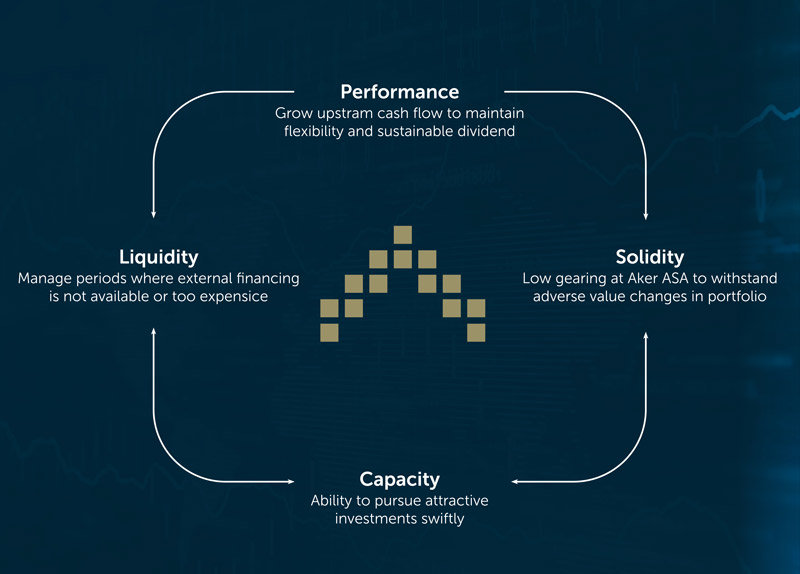

Financial Objectives

Deliver competitive total returns to shareholders on a year-over-year basis.

Maintain a strong and resilient balance sheet to protect the company from adverse portfolio developments and market fluctuations.

Preserve a solid liquidity buffer to ensure financial flexibility—enabling the company to act swiftly on strategic opportunities and withstand periods of market downturn.

Sustain annual dividend distributions equivalent to 4–6% of the company’s value-adjusted equity, reinforcing long-term shareholder value.

Debt Strategy

Green Finance Framework

Aker ASA and Aker Horizons with subsidiaries

The Green Finance Framework has been verified by DNV GL and enables Aker ASA and its affiliated company Aker Horizons ASA to finance investments which contribute to climate friendly activities and a sustainable environment with Green Bonds and Loans.

Aker’s Credit Framework

Interest-bearing Items

Aker ASA and Holding companies held net interest-bearing debt of about NOK 2.0 billion as per 30 June 2025.

| Main interest-bearing receivables of MNOK 6,262 are as follows: | |

|---|---|

| 30/06/2025 | |

| Aker Horizons AS | 3,273 |

| Various others | 2,989 |

| Total main interest-bearing receivables | 6,262 |

Debt

Aker's bond financing constitutes the majority of the company’s total debt financing. All bonds are senior unsecured.

Total debt in Aker ASA and Holding companies as of 30 June 2025 is as follows (the bond loan agreements are attached to the links below):

| Ticker | Issue | Maturity |

Loan term (years) |

Coupon |

Loan amount (MNOK) |

Outstanding Amount 1 (MNOK) |

|---|---|---|---|---|---|---|

| Bonds | ||||||

| Green Bond AKER16 | 27.09.2022 | 27.09.2027 |

5 |

N3M+275 |

1 300 |

1 300 |

| Green Bond AKER17 | 27.09.2022 | 27.09.2027 |

5 |

6.28% |

700 |

700 |

| Green Bond AKER18 | 17.11.2022 | 17.11.2029 |

7 |

6.50% |

500 |

500 |

| Green Bond AKER19 | 22.11.2022 | 22.11.2032 |

10 |

6.30% |

500 |

500 |

| AKER20 | 15.01.2024 | 15.01.2029 |

5 |

N3M+187 |

1 250 |

1 250 |

| AKER21 | 15.04.2024 | 15.04.2031 |

7 |

N3M+180 |

500 |

500 |

| Total Bonds Aker ASA |

4 750 |

4 750 |

||||

| Revolving Credit Facilities 2) | 2022-2024 | 2028-2029 |

|

3-5 |

10 000 |

4 311 |

| Capitalised loan fees etc. |

-43 |

-43 |

||||

| Total bank debt Aker ASA |

9 958 |

4 268 |

||||

| Total debt Aker ASA and holding companies |

14 708 |

9 018 |

1) Loan amount drawn, less own bonds and/or repayments

2) Revolving credit facilities (RCF) of NOK 10 bn at 3-5 y maturity, with up to two annual extension options

Bond prospectus

Click to read: Base Prospectus Final Terms Aker ASA Jun 2024

Click to read: Listing Prospectus Aker ASA Dec 2022

Credit Analysts

The below table provides an overview of the fixed income analysts who cover Aker ASA.

| COMPANY | ANALYST | TELEPHONE | |

|---|---|---|---|

| Danske Bank | Mille Opdahl Müller | +47 85 40 77 27 | [email protected] |

| DNB Markets | Espen Korsmo Granly | +47 24 16 93 64 | [email protected] |

| Nordea Markets | Martin Thorsen Kulsrud | +47 24 01 39 27 | [email protected] |

| Pareto Securities | Thomas Eriksen | +47 24 13 21 71 | [email protected] |

| SEB | Håkon Lillelien | +47 46 80 33 06 | [email protected] |

| SpareBank 1 Markets |

Pål Holdø Dahl Christopher Møllerløkken |

+47 24 13 37 14 +47 24 14 74 21 |

[email protected] [email protected] |

Treasury Contact

Aker ASA treasury contact: [email protected]